In a world where technology continuously reshapes our daily lives, the realm of business transactions is not left behind.

The landscape of buying, selling, and managing money is undergoing a revolutionary transformation through innovative payment systems. These advancements are ushering in a new era where transactions are not only faster and more secure but also incredibly convenient.

This guide provides insights into the latest trends in modern payment systems, including a comprehensive look at world payment systems. We cover a range of topics, from digital wallets to blockchain technology. We will uncover these advancements and provide practical insights into their application in various business scenarios.

So, whether you’re a business owner looking to upgrade your payment methods, a consumer curious about the future of transactions, or simply someone keen on staying ahead in the digital age, this guide is for you.

Let’s begin!

The Role of World Payment Systems

As we delve deeper into modern payment methodologies, it’s crucial to understand the concept of world payment systems. These systems encompass a broad range of transaction methods used globally. It includes credit card processing networks and innovative blockchain-based solutions.

They are the backbone of international trade and commerce, facilitating seamless cross-border transactions. In addition:

- These systems often focus on interoperability, ensuring different payment methods and currencies can be used seamlessly across different platforms and countries.

- They offer real-time processing capabilities, significantly reducing the transaction time for international payments.

- These systems must navigate and comply with a pool of international regulations, ensuring secure and legal transactions across various jurisdictions.

The Evolution of Payment Systems

Remember the days when cash was king and checkbooks were a wallet staple? Fast forward to today, and the landscape of transactions has transformed dramatically.

The shift from traditional to digital has been swift and revolutionary, creating a new era in the world of payment systems. Additionally:

- The rise of online banking and E-transfers enables quick and secure money transfers without the need for physical banking facilities.

- The availability of payment gateways provides secure and efficient processing of payments between buyers and sellers in eCommerce.

- Contactless cards allow users to make payments by simply tapping their card on a payment terminal.

Digital Wallets: Your Money, Just a Click Away

Imagine having all your financial resources in one place, accessible with just a tap on your smartphone. Digital wallets have made this a reality.

These nifty tools allow you to store card information securely and make transactions effortlessly. They’re not just about convenience; they’re about revolutionizing accessibility and security in financial transactions.

Cryptocurrencies: The New Frontier

Cryptocurrencies, like Bitcoin and Ethereum, have stirred up the finance world, offering an alternative to traditional currencies.

These digital assets operate on blockchain technology, ensuring transparency and security. While they may seem daunting at first, understanding cryptocurrencies is key in navigating the future of transactions. Further insights include:

- Cryptocurrencies operate on decentralized networks, offering a level of freedom from traditional banking systems and governmental control.

- The use of smart contracts in blockchain technology automates and secures transactions without the need for intermediaries.

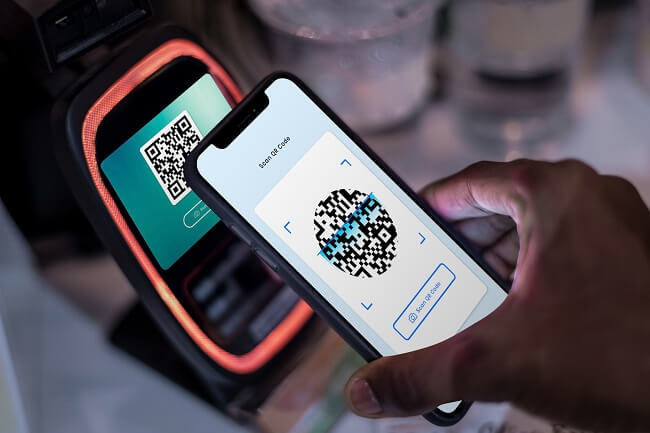

Contactless Payments: The Touch-Free Revolution

Gone are the days of swiping cards or exchanging cash. Contactless payments using NFC (Near Field Communication) technology have become the new norm. Simply tap your card or phone, and voilà! The transaction is complete.

This method is not just about speed; it’s about reducing physical contact, which has become increasingly important in our current health-conscious world. Further:

- Beyond cards and phones, contactless technology is also being integrated into wearable techs like smartwatches and bracelets.

- Many regions are raising the transaction limits for contactless payments, making them viable for a broader range of purchases.

- Contactless payments are increasingly integrated into public transport systems, allowing for easy and fast fare payments.

eCommerce Platforms: Bridging Businesses and Consumers

The rise of eCommerce platforms has revolutionized how businesses interact with consumers. Platforms like Shopify and WooCommerce provide businesses of all sizes with the tools to set up online stores, process payments, and manage inventory all in one place.

This has democratized the ability to do business online, offering opportunities to even the smallest of vendors. Additionally:

- eCommerce platforms increasingly focus on mobile-friendly interfaces, acknowledging the growing mobile shopping trend.

- Many platforms now offer integrated marketing tools, helping businesses to reach a wider audience effectively.

- These platforms allow for extensive customization and personalization, enabling businesses to create unique customer brand experiences.

Wrapping It All Up

The world of modern payment systems is dynamic and ever-evolving. As you navigate this landscape, it’s crucial to stay informed and adaptable to use the full potential of these innovations. All you have to do is embrace the change, and you can lead the digital transaction race. Welcome to the future of business transactions, i.e., exciting, secure, and at your fingertips.